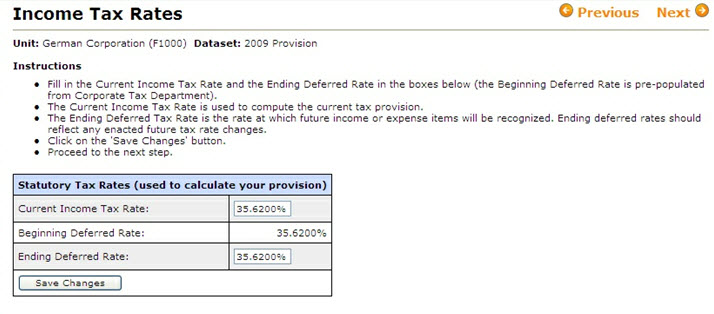

The Income Tax Rates page gives you input fields for the current income tax rate, and the ending deferred tax rate. The beginning deferred tax rate displays for your review only. This field cannot be edited.

If there are different tax rates in effect due to tax law changes, the appropriate tax rate for each item should be entered in the Current and Ending Tax Rate fields.

When you finish entering the appropriate Statutory Tax Rates, click Save Changes. You can follow the sequence for populating the remaining unit information by clicking the Next link. You can also proceed to the next page by clicking Permanent Diffs in the left navigator.

Administrators can make the current, beginning deferred, and/or ending deferred tax rates read-only, or all three fields can be hidden from view by local users. For more information, refer to the Administration section.