| 1. | Select Data Transfer on the Navigator pane. |

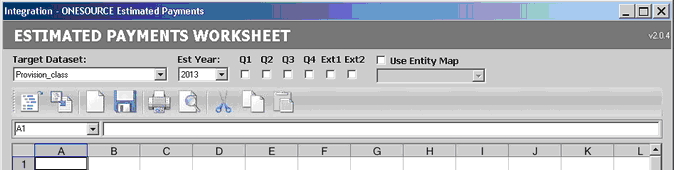

| 2. | Select ONESOURCE Estimated Payments. The Estimated Payments Worksheet opens. |

| 3. | Check that the following fields are correct: |

| o | Quarter or Extension, for example Q1 or EXT1. |

4. Click the Retrieve Data icon.

| • | Click Retrieve State Payments, Retrieve Federal Payments, or Retrieve Federal and State Payments. |

5. Select Populate Data to Provision.

The status bar shows the transfer is in progress.

| 6. | Review the Estimated Payments Dataset. |

| a. | The Estimated Worksheet is saved in Global Attachments, within the System folder in Administration. |

| b. | To review the Estimated Payment log file, select Data Transfer, Status and then ONESOURCE Estimated Payments Logs. |

| c. | To verify the transferred data, select Data Input and verify the Target Dataset in the Control Center. |

| d. | Select Federal or State Payable and review the transferred data. |

| e. | A unique Data Source icon will appear the for Unit Payable Data Review and Audit Trail data populated from Estimated Payments.  |

Notes:

| • | When data is transferred multiple times and has all the same attributes the transferred data will write over the existing data. If you change one of the attributes then, a new line item will appear when you populate the Payable Entry screen. For example, if you select a different Txn Type for the additional data transfer a new line appears for the Unit Payable Data Review with that Txn Type along with that Amount. |

| • | The data transferred will include Franchise Tax as part of the payable amount. |

|