|

Version 2014’s Interim Reporting enhancements give you more options and flexibility for monthly and quarterly reporting.

What's new

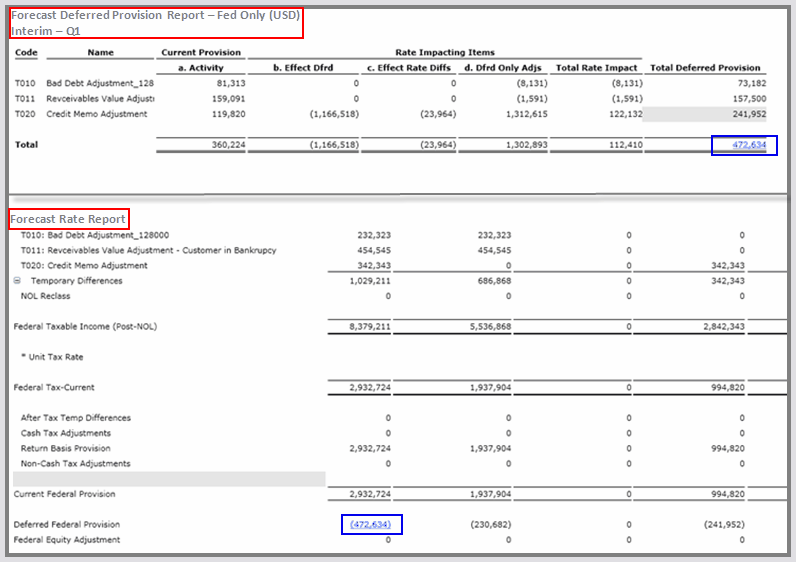

| • | A new report is available to review your Forecast Deferred Provision data and verify Federal/State Forecast Deferred Provision amounts. |

| • | You now have an option for the State Forecast to be based on Worldwide Income. |

| • | You now have an option for the Actual Effective Tax Rate report to be based on the Worldwide Actual Income. |

| • | You now can present the effective tax rate on a consolidated basis and include both income and loss companies. |

What's CHANGED

Changes from Version 2013.1 to Version 2014:

Version 2013.1

| • | A report detailing the Forecast Deferred Provision did not exist. |

| • | The Actual Effective Tax Rate calculation, did not include "Excluded Units" or "Excluded Foreign Losses." |

| • | The State Forecast Rate only included units with an active state record. |

Functionality Visual

Reporting - Forecast Deferred Provision hyperlinks

|