|

The State Rates option allows the data transfer of both the State Apportionment Rates and the State Tax Rates.

| • | The Apportionment Rates transfer from the State Tax Returns. The transferred data can be confirmed by reviewing the TI Review Workpapers in ONESOURCE Income Tax. The consolidated apportionment transfers from the consolidation return and the non-consolidated apportionment transfers from the separate state return. |

Note: Refer to the ONESOURCE Income Tax User Guide for more information about State Allocation & Apportionment and State TI Workpapers.

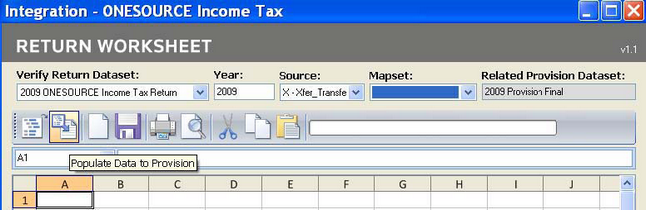

| • | The State Tax Rates transfer from the State Tax Rate Chart. The Chart is regularly maintained and has the highest rates the states require. The State Tax Rates can be attained for any year desired using the transfer. On the Return Worksheet, define the Year for the year of the desired State Tax Rates. The year of the dataset or the mapset does not matter in this case. A “dummy” dataset must be created and related for this transfer. This will be the “Related Provision Dataset” in order to transfer the State Tax Rates for the current year. |

|