|

Deferred Balances Report in the Expanded (Balance Sheet) View

| • | Beginning Balance column balances are converted using the Beginning Spot rate and the Beginning Tax rate. |

| • | The Rate Change column creates an adjustment to restate the Beginning Balance column at the Ending Spot rate and the Ending Tax rate. |

| • | All other Columns are converted using the Ending Spot rate and the Ending Tax rate. |

| • | The Ending Balance is the sum of the columns and is effectively the Ending Balances converted using Ending Spot Rate and the Ending Tax rate. |

Deferred Balances Report in the CIR Expanded (Balance Sheet) View

| • | The Rate Change column is broken out into FX Rate Change and Def Rate Change. |

| • | The FX Rate Change is the impact of the FX rate change on the beginning balance, including the impact of any FX rate change from a change in the deferred rate. |

| • | The Deferred Rate Change is the impact of the deferred rate change on the beginning balances. |

| • | More detail on each of the rate change activities can be displayed by viewing the Deferred Balances report in the Expanded (Income Statement) view. |

FX Rate Change

The FX Rate Change is the impact of the FX rate change on each of the beginning balances, including the impact of any FX rate change from a change in the deferred rate:

(Beginning Balance / Beginning FX Spot Rate)

– (Beginning Balance / Ending FX Spot Rate)

+ (Beginning Balance X (Ending Deferred Rate – Beginning Deferred Rate) / Ending FX Spot Rate)

– (Beginning Balance X (Ending Deferred Rate – Beginning Deferred Rate) / Weighted Avg FX Rate)

Def Rate Change Computations

The Deferred Rate Change is the impact of the deferred rate change on each of the beginning balances. [((Beginning Balance X Ending Deferred Rate) / Weighted Avg FX Rate) – ((Beginning Balance X Beginning Deferred Rate) / Weighted Avg FX Rate)].

Deferred Balances Report in the Expanded (Income Statement) View

| • | Currency Translation Adjustment. |

| • | Deferred Balances in USD are translated from Local Currency Balances using the Beginning and Ending Spot FX Rates. |

| • | USD Change in Deferred Balances. |

| • | Deferred Expense in USD is translated from the Local Currency Activity using Weighted FX Rates |

| • | Currency Translation Adjustment Computation |

| • | Adjusts the Weighted Average FX Impact and the Ending Spot FX Rate |

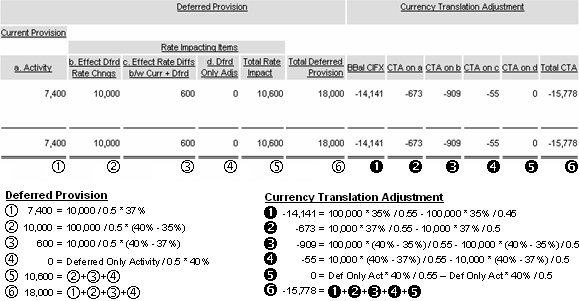

Detail of CTA Calculation Components

Information for the Calculation:

|

|

|

|

Beginning Temporary Difference Balance

|

100,000

|

|

|

Temporary Difference Activity

|

10,000

|

|

|

|

|

|

|

Beginning FX Spot Rate

|

0.45

|

Current Tax Rate

|

37%

|

Ending FX Spot Rate

|

0.55

|

Beginning Deferred Tax Rate

|

35%

|

Weighted Average FX Rate

|

0.50

|

Ending Deferred Tax Rate

|

40%

|

|