|

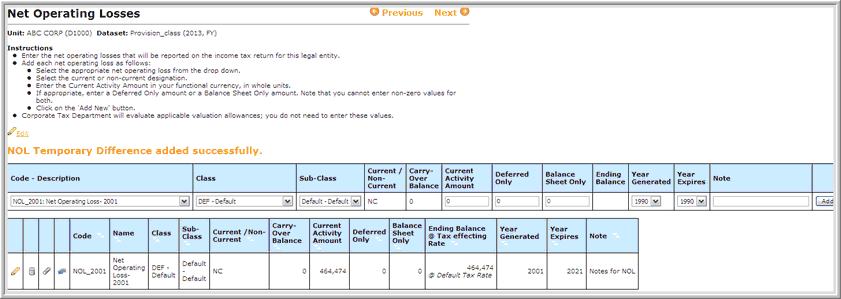

Enter the Net Operating Loss (NOL) for the unit selected in local currency. NOL_SYS automatically generates a NOL when taxable income is negative; it also automatically uses NOLs when income is present.

Note: Administrators can also activate the NOL automation in ONESOURCE Tax Provision by selecting the Enable NOL Automation parameter in Manage Configurations.

Enter a separate line item for each net operating loss:

| 1. | Select the Code-Description and then Tag or Class/Sub-Class. |

| 2. | Select C for current or NC for non-current to indicate whether the NOL item is classified as current or non-current. |

| 3. | The carryover balance, if any, automatically appears. |

| 4. | Enter the Current Activity Amount in local currency. |

| 5. | Enter the Deferred Only adjustment. |

| 6. | Enter the Balance Sheet Only adjustment. |

| 7. | Enter the Year Generated. |

| 8. | Enter the Year Expires. |

| 9. | Click Add New to create the NOL. |

| • | Users can attach files to an individual NOL item on this page. If users have supporting documents, click the paper clip or filing cabinet next to the item. |

| • | Users can add and update notes for a line item. |

Notes:

| • | If a new NOL item is required, contact the Corporate Tax Department. |

|