|

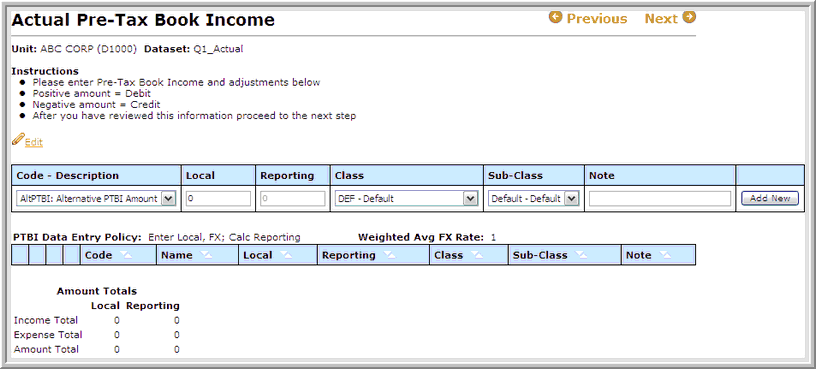

In the Pre-Tax Book Income page, users can enter Pre-Tax Book Income in local currency per the tax return for a domestic company.

| • | The PTBI code drop-down list depends on the assignments made for the unit in Administer Permissions. |

| • | The PTBI policy and Weighted Avg FX Rate are set up in the Unit Details section of the ONESOURCE Tax Provision program by an administrator. |

| o | Depending on the Pre-Tax Book Income policy selected, Global Access users can modify appropriate fields on this page. |

| • | Users can enter notes for each line item. |

| o | The program does not require users to enter notes. |

| o | Users can enter alphanumeric and special characters for Notes; notes can have up to 255 characters. |

| o | Notes can be added to all data entry pages. |

| • | The Amount Totals appear in local and reporting currencies.The Income Total and Expense Total are the sum of the of income and expenses. |

| • | Administrators can set the permissions for the Income Totals, Expense Totals, and Amount Totals to “Show” the information is hidden by default. |

Note: Administrators have the ability to Apply classes, tags and group permissions. They also can hide the Pre-Tax Book Income as well as set up the Pre-Tax Book Income as read-only. For more information, refer to the Administration section.

|