|

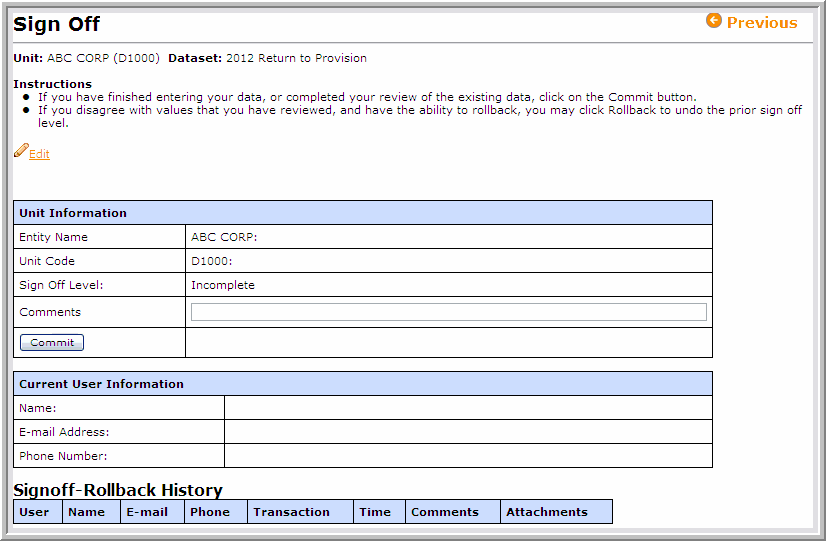

In the Sign-Off page, users can indicate that:

| • | The unit data entry is complete. |

| • | The users have signed off on the tax provision calculation. |

| • | The users are ready to post the return-to-provision adjustments. |

| • | Users can attach any files upon the sign-off of each unit. |

To commit or rollback a unit:

| 1. | Once the unit data entry is complete, review the true-up. |

| 2. | Next, review the following reports: current tax provision, deferred tax provision, and effective tax rate. |

| 3. | If needed, make changes to complete the tax provision calculation. |

| 5. | Click Attach to download a file for the history. |

| • | If the user commits the work on a unit and then additional changes are needed, the user must contact the Corporate Tax Department and request that the unit is rolled back to the user. |

| • | Administrators can roll back users one level at a time. |

Note: Administrators have the ability to set up users with specific sign-off roles in the Administration page. They can also set up User Contact Information in ONESOURCE Tax Provision. For more information, refer to the Administration section.

|