|

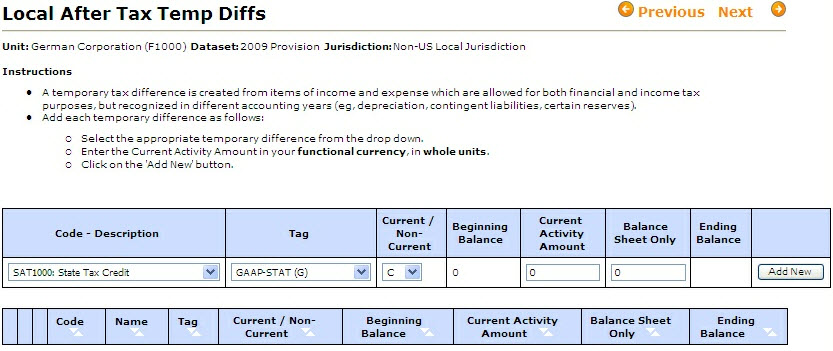

The Local After Tax Temporary Differences page allows you to enter after tax adjustments that are temporary in nature. An example of an After Tax Temporary Difference is a tax credit with a carry-forward amount.

Enter a separate line item for each Local After Tax Temporary Difference:

| 1. | Select the appropriate code-description from the drop-down menu in the first column. |

| 3. | The carryover balance, if any, is automatically pre-populated. |

| 4. | Enter the current activity amount in local currency. |

| 5. | There are fields for entering deferred adjustments and balance sheet only adjustments. Enter the appropriate amounts, if applicable. |

| 6. | Click Add New to create the temporary difference. |

Note:

| • | If a new local after tax temporary difference item is required, contact the Corporate Tax Department. |

After a temporary difference item is created, you can edit or delete the item by clicking the appropriate icon. Click the pencil icon to edit the entry. Select Save Changes after making any changes. You can attach files to an individual temporary difference items on this page. If you have supporting documents, click the paper clip icon next to the item.

The impact of individual temporary differences on your tax provision can be viewed on the Local Tax Provision report and the Local Tax Provision report.

|