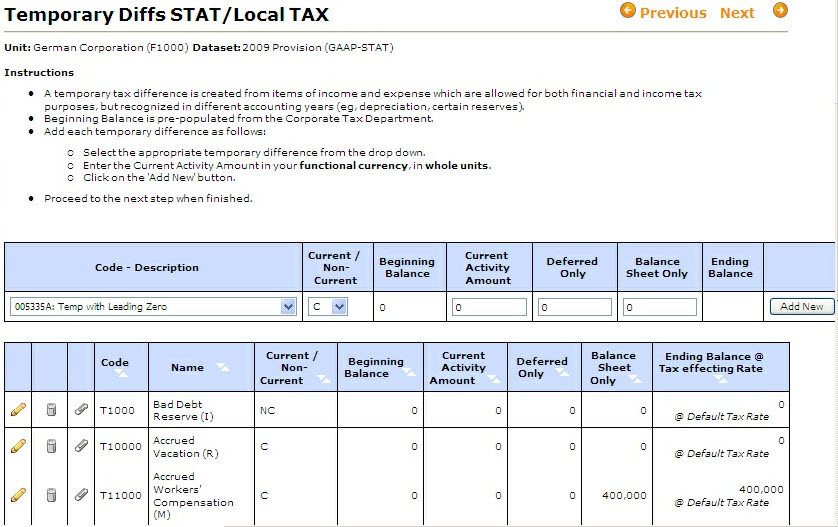

The Temporary Differences STAT/TAX page allows you to enter differences between book income computed under Statutory Law and Local Tax Law in your country that are temporary in nature. These differences will reverse in the future.

Enter a separate line item for each Temporary Difference:

| 1. | Select the appropriate code-description from the drop-down menu in the first column. |

| 2. | Indicate whether the item is classified as current or non-current. |

| 3. | The carryover balance, if any, is automatically pre-populated. |

| 4. | Enter the current activity amount in local currency. |

| 5. | There are also fields for entering deferred adjustments and balance sheet only adjustments. Note: Refer to the Where to Enter Items in ONESOURCE Tax Provision section for more information on the different types of adjustments (i.e., current activity, deferred only, and balance sheet only). |

| 6. | Click Add New to create the temporary difference. |

Note: If a new temporary difference item is required, contact the Corporate Tax Department.

After a temporary difference item is created, you can edit or delete it by clicking the appropriate icon. Click the pencil icon to edit the entry. Select Save Changes after making any changes. You can attach files to individual temporary difference item on this page. If you have supporting documents, click the paper clip icon next to the item.

The impact of individual temporary differences on your tax provision can be viewed on the Tax Provision report and the Effective Rate report.

To view separate pages for GAAP to STAT and STAT to TAX, datasets must be published as yeprovgs. For more information, refer to the Administration section.