|

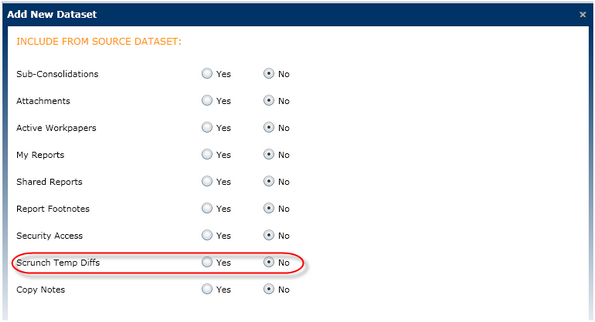

When you scrunch a dataset, you can include the following items in the rolled over dataset: Subconsolidations, Attachments, Active Workpapers, My Reports, Shared Reports, Report Footnotes, Security Access, Scrunch Temporary Differences and Copy Notes.

Scrunch Temporary Differences combines the data by code and temporary difference type with the same rate for the following components:

| • | Temporary Differences - Tax Basis |

| • | Temporary Differences - Book/Tax Basis |

| • | After Tax Temporary Differences - Tax Basis |

| • | After-Tax Temporary Differences - Book/Tax Basis |

| • | NOL Temporary Differences - Tax Basis |

| • | State Temporary Differences - Tax Basis |

| • | State After Apportionment Temporary Differences - Tax Basis |

| • | State After Tax Temporary Differences - Tax Basis |

To "Scrunch" a dataset:

| 1. | Select Administration and then Manage Datasets. |

| 2. | Click Datasets and then Add New Dataset. |

| 3. | For "Transaction", select Rollover. |

| 5. | Select the items to include in the "rolled over" dataset. |

| 6. | Select Scrunch Temp Diffs to sum current and non-current temporary differences with different tag letters assigned to them. |

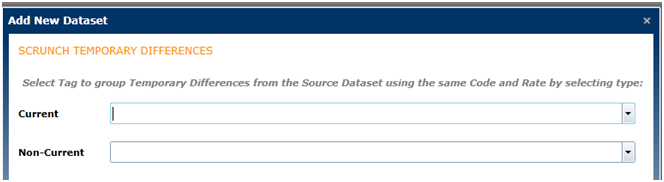

| 8. | For "Scrunch Temporary Differences", select a Tag or Class. |

| 10. | For the "refresh report data" message, select Yes to update the reports with the scrunched data. Select No if you do not wish to update the reports at this time. |

Note: A new scrunched record is created for each unique combination of the Code, C/NC designation and ending deferred rate in the source dataset. If there are multiple groups of source records that differ only by Ending Deferred Rate, then the system will generate a unique numeric value to use as the record’s subclass. This system-generated subclass will distinguish one like record from other similar records and will allow the system to create as many scrunch records as needed per the number of unique ending rates in the source dataset.

For example, a source dataset may have 4 temporary difference records all sharing the same Code and C/NC designation, but two records have identical overridden ending deferred rates and two records have not overridden the ending rate. In this case, two scrunched records are created, one for the two records that have identical overridden rates and one for the two that have not overridden the rates. The first record will be created with the default subclass of the class chosen in the wizard and the second will be created with the same class as the first record but with a system-generated numeric subclass, for example, “1”. The system will increment the numeric subclass for each record it needs to create for the same unique Code and C/NC.

This system-generated subclass will not be visible to Administrators in the Administration and cannot be modified.

To set up tags and classes for the scrunch functionality:

| • | To scrunch temporary differences in a new dataset with tags, choose one tag applicable for the current temporary differences, and another tag applicable for the non-current temporary differences from the source dataset. You cannot use the same tag name to scrunch the current and non-current temporary differences. |

| • | To scrunch temporary difference in the new dataset with classes, choose one class applicable to the current temporary differences, and another class applicable to the non-current temporary differences from the source dataset. You cannot apply the same class name to scrunch current and non-current temporary differences. |

Rules:

| • | When you select Scrunch Temp Diffs to sum the temporary differences, the total Ending Balances for Temporary Difference in the "Source" dataset will be the Beginning Balances in the "Rollover" dataset. The Beginning Balances appear as single balances along with the Tag or Class selected during the "Rollover" process. |

| • | The application will scrunch data and create a separate entry for the current and non-current type temporary differences using two different tags or classes (depending on whether it is a tag dataset or class dataset). |

| • | Federal and State data is scrunched even when the option to overwrite the Federal/State rate is selected. |

| • | The system will not scrunch temporary differences with an overwritten line item rate. |

| • | The dataset parameter SCRUNCH_TAG with Alphanumeric value is no longer applicable. This dataset parameter applies to the ONESOURCE Tax Provision v. 9.2 and earlier. |

| • | The Copy Notes option is not available when the scrunch functionality is selected for the new dataset. |

Additional requirements:

| • | NOL: Entries must have the same Ending Rate, Year Generated, and Year Expired. |

| • | Book/Tax Basis: Entries must have the same Ending Rate, Book Months, and Tax Months. |

| • | After-Tax - Book/Tax Basis: Entries must have the same Book Months and Tax Months. |

| • | Federal/State: Entries must have the same Ending Rate. |

| • | State After-Apportionment: Entries must have the same Ending Rate. |

| • | State/State After-Apportionment: Entries must have the same Ending Federal Rate. |

|