|

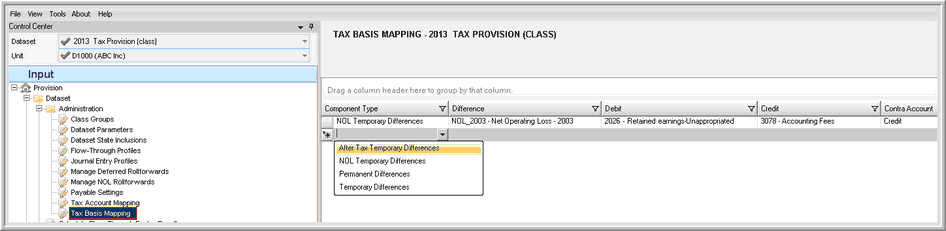

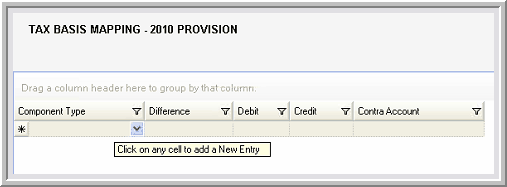

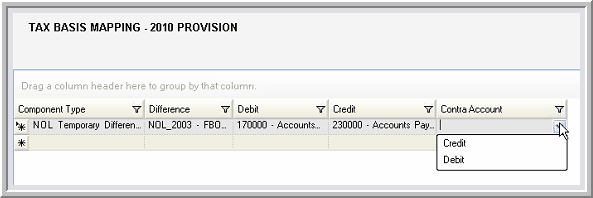

The Tax Basis Mapping option is located in a Provision dataset within the Data Input list in the Dataset Administration folder.

| • | The temporary difference and trial balance sublines are set up in the Trial Balance Sublines page in the Administration area. |

| • | The trial balance sublines are available in the Debit and Credit drop-down lists. The sublines remain in the lists, even after the sublines are assigned to a temporary difference. |

| • | You can map multiple temporary differences to the same trial balance sublines. |

| • | The same trial balance subline can be entered as a debit and credit for a single temporary difference. |

| • | Once a temporary difference is added with a mapping the Temporary Differences will not appear in the list. |

| • | If data is associated with a specific mapping, the mapping cannot be changed or deleted unless the data is removed from the dataset. |

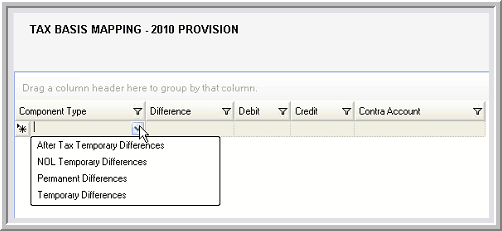

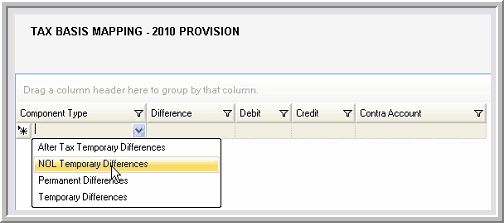

| • | Mapping is available for Component Types of After Tax Temporary Differences, NOL Temporary Differences, Permanent Differences, and Temporary Differences. |

| • | Ability to set one account as the offsetting Contra Account when both sides post to the Balance Sheet. |

You can layer Temporary Differences to create the Tax Basis Balance sheet with the Tax Basis Mapping.

Notes:

Component Types available: After Tax Temporary Differences, NOL Temporary Differences, Permanent Differences, Temporary Differences.

You can designate whether the debit account or the credit account has the reverse sign. Then, the two temporary adjustments will offset each other.

You can set up a Contra Account when you are setting up two Balance Sheet accounts and select a Credit or Debit balance for the entry.

|