|

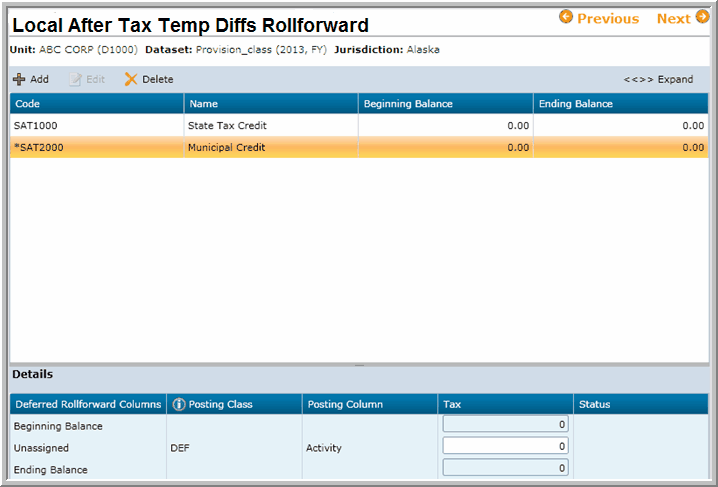

In the Local After Tax Temporary Differences page, users can enter after tax adjustments that are temporary in nature. An example of an After Tax Temporary Difference is a tax credit with a carry-forward amount.

Enter a separate line item for each local after tax temporary difference:

| 1. | Select the Code-Description and then Tag or Class/Sub-Class. |

| 2. | Click Add New. A window appears for users to type amounts. |

Note:

| • | If a new local after tax temporary difference item is required, contact the Corporate Tax Department. |

After a local after tax temporary difference item is created, users can edit or delete the item by clicking the appropriate icon.

| 1. | Click the pencil icon to edit the entry. |

| 2. | Select Save Changes after making any changes. |

| • | Users can attach files to an individual local after tax temporary difference item on this page. If users have supporting documents, click the paper clip or filing cabinet next to the item. |

| • | Users have the ability to add and update notes to a line item. Users click on the notes icon then add notes. |

| • | The impact of an individual local after tax temporary difference on the tax provision can be viewed on the Local Tax Provision report. |

|