|

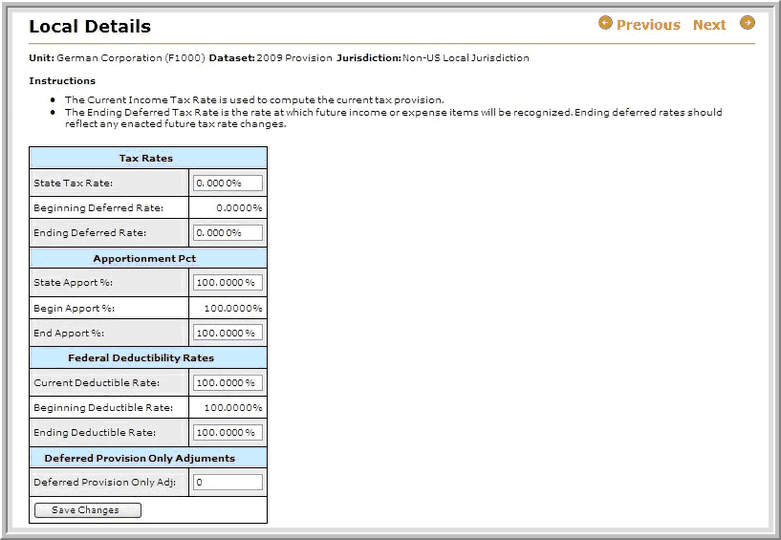

The Local Details page gives users input fields for:

| • | The current income (State) tax rate. |

| • | The ending deferred (State) tax rate. |

| • | The current apportionment percentage. |

| • | The ending apportionment percentage. |

| • | The current deductible rate. |

| • | The ending deductible rate. |

| • | The deferred provision only adjustments. |

The beginning deferred tax rate appears for review only. This field cannot be edited. If there are different tax rates in effect due to tax law changes, the appropriate tax rates are entered in the current and ending tax rate fields.

Descriptions of Key Rate Fields:

| • | Apportionment Percentage: The percentage of the national (federal) taxable income that is included when calculating the local tax provision. The percentage is 100 if the starting point of the local tax provision is the national (federal) taxable income. |

| • | Federal (National) Deductibility Rates: The percentage of the state tax expenses that is deductible on the national (federal) tax provision calculation. The percentage is 0 if local taxes are not deductible on the national (federal) level. |

| • | Deferred Provision Only Adjustments: Adjustments to the deferred tax provision expense. They are presented as a separate line item, and they impact the Effective Tax rate. These adjustments do not have a related deferred tax or liability associated with them. |

If there are different rates in effect due to tax law changes, the appropriate tax rate for each item is entered in the Current and Ending Tax Rate fields.

| 1. | Users Type the appropriate Tax Rates, Apportionment Pct, and Deferred Provision Only Adjustments. |

| 3. | Click Next and then enter the remaining unit information. |

| 4. | Click Permanent Diffs in the navigator menu to continue data entry. |

Note: Administrators can make the current, beginning deferred, and/or ending deferred tax rates read-only, or all three fields can be hidden from view by local users. For more information, refer to the Administration section.

|