|

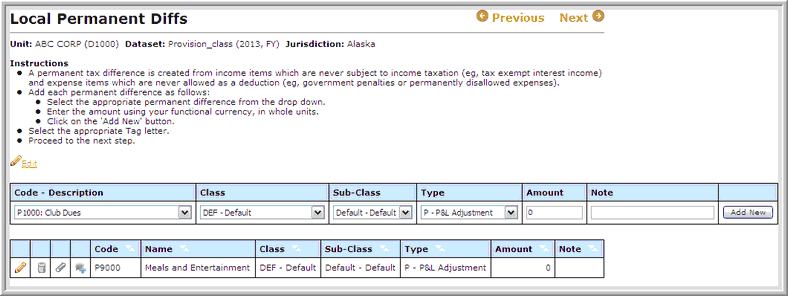

In the Local Permanent Differences page, users can enter differences between National Taxable Income and Local Taxable Income that are permanent in nature; the differences do not reverse in the future. Because permanent differences often transfer from the federal calculation, only the difference between the national and local amounts for a permanent difference is entered on the Local Permanent Differences page. Refer to Scenario 2 on the Local Jurisdiction page of this manual, in which the amount entered for the local permanent difference would be -10,000.

Enter a separate line item for each local permanent difference:

| 1. | Select the Code-Description and then Tag or Class/Sub-Class. |

| 2. | Select the Type for the local permanent difference item. It is usually a P&L adjustment. However, if users are entering an item that does not have any impact on the current tax expense; for example, for stock option expense, select the E - Equity adjustment. Refer to the Where to Enter Items in ONESOURCE Tax Provision section for more information on the types of local permanent difference items. |

| 3. | Type the amount in local currency. |

| 4. | Click Add New to create the local permanent difference. |

After a local permanent difference item is created, users can edit or delete the item by clicking the appropriate icon.

| 1. | Click the pencil icon to edit the entry. |

| 2. | Select Save Changes after making any changes. |

| • | Users can attach files to an individual local permanent difference item on this page. If users have supporting documents, click the paper clip or filing cabinet next to the item. |

| • | Users have the ability to add and update notes to a line item. Users may click on the notes icon then add notes. |

Note: If a new local permanent difference item is required, contact the Corporate Tax Department.

|