|

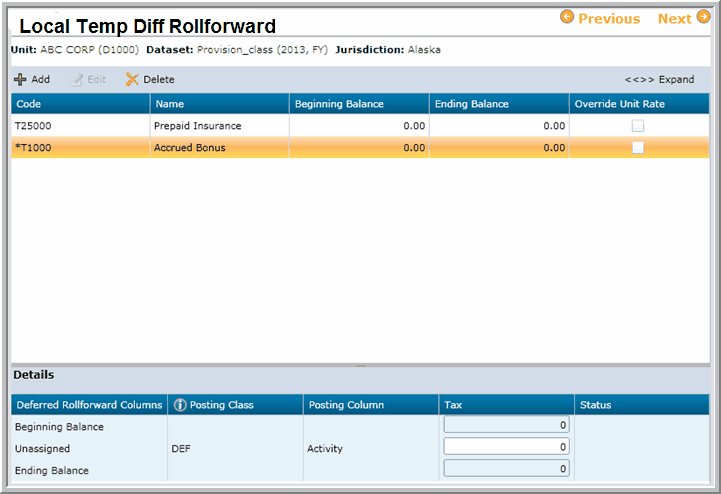

In the Local Temp Diff Rollforward page, users can enter differences between National Taxable Income and Local Taxable Income that are temporary in nature; for example, these differences will reverse in the future. Because temporary differences often flow from the national calculation, only the difference between the national and local amounts for a temporary difference is entered on the Local Temporary Differences page. Refer to Scenario 2 on the Local Jurisdiction page of this manual, in which the amount entered for the local temporary difference would be 25,000.

Enter a separate line item for each local temporary difference:

| 1. | Select the Code-Description and then Tag or Class/Sub-Class. |

| 2. | Click Add New. A window appears for users to type amounts. |

After a local temporary difference item is created, users can edit or delete the item by clicking the appropriate icon.

| 1. | Click the pencil icon to edit the entry. |

| 2. | Select Save Changes after making any changes. |

| • | Users can attach files to an individual local temporary difference item on this page. If users have supporting documents, click the paper clip or filing cabinet next to the item. |

| • | Users have the ability to add and update notes to a line item. Users may click on the notes icon then add notes. |

Notes:

| • | If a new local temporary difference item is required, contact the Corporate Tax Department. |

|