|

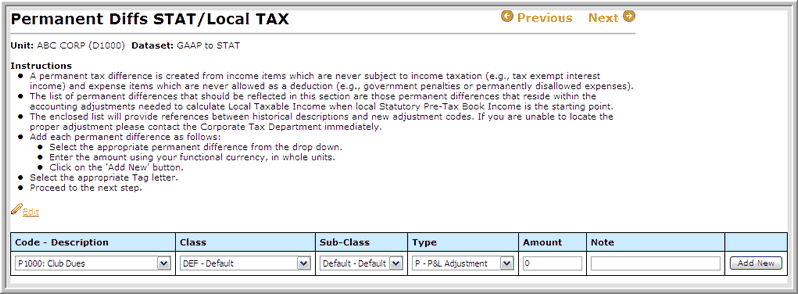

In the Permanent Diffs STAT/Local TAX page, users can enter differences between book income computed under Statutory Law and Local Tax Law that are permanent in nature; these differences will not reverse in the future.

Enter a separate line item for each permanent difference:

| 1. | Select the Code-Description and then Tag or Class/Sub-Class. |

| 2. | Select the Type of the permanent difference item. It will usually be a P&L adjustment. However, if users are entering an item that does not have any impact on the current tax expense; for example stock option expense, select E - Equity adjustment. |

| 3. | Enter the amount of the permanent difference in local currency. |

| 4. | Click Add New to create the permanent difference. |

After a permanent difference item is created, users can edit or delete it by clicking the appropriate icon.

1. Click the pencil icon to edit the entry.

2. Select Save Changes after making any changes.

| • | Users can attach files to an individual permanent difference item on this page. If users have supporting documents, click the paper clip or filing cabinet next to the item. |

| • | Users can add and update notes for a line item. |

| • | To view separate pages for GAAP to STAT and STAT to TAX, datasets must be assigned as yeprovgs. For more information, refer to the Administration section. |

Notes:

| • | If a new permanent difference item is required, contact the Corporate Tax Department. |

|