|

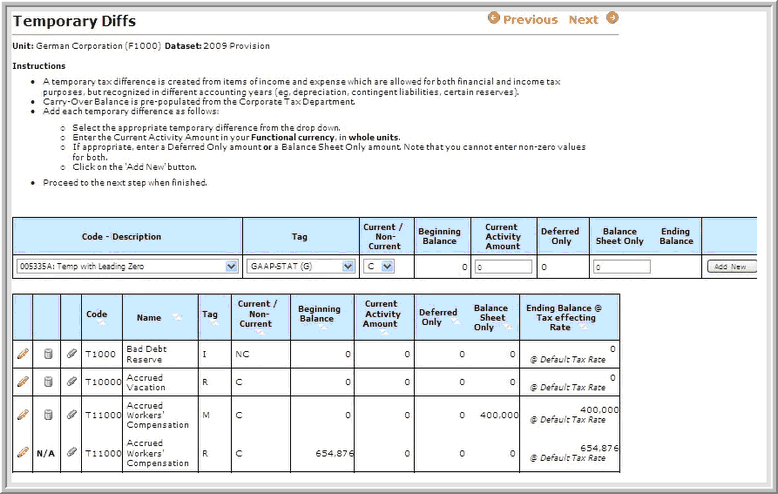

Users can enter differences that will reverse in the future in the Temporary Diffs Tax Basis page. Some examples of temporary differences include; temporary disallowed expenses, accruals, and reserves which will be deducted in later years, as well as book income not subject to current taxation under the statutory laws of the country. In order to view this page, the page must be selected in Manage User Permissions.

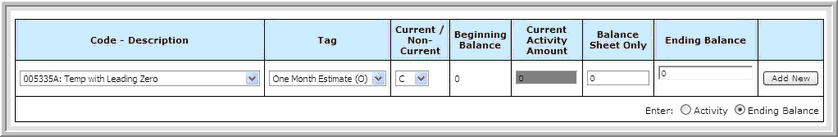

| • | Users can input an ending balance amount and have the program calculate the current activity using the balance sheet approach. Administrators activate the balance sheet approach using a parameter. However, even with this parameter, Global Access users still have the option to take either approach for each line item. |

| • | Users can enter only the ending balance for the book balance and not the tax balance. |

Enter a separate line item for each temporary difference:

| 1. | Select the Code-Description and then Tag or Class/Sub-Class. |

| 3. | The carryover balance, if any, is automatically pre-populated. |

| 4. | Enter the current activity amount in local currency. |

| 5. | There are also fields for entering deferred adjustments and balance sheet only adjustments. |

| 6. | To edit the Ending Balance, click the Ending Balance Override check box. |

| 7. | Click Add New to create the temporary difference. |

After a temporary difference item is created, users can edit or delete it by clicking the appropriate icon.

| 1. | Click the pencil icon to edit the entry. |

| 2. | Select Save Changes after making any changes. |

| • | Users can attach files to an individual temporary difference item on this page. If users have supporting documents, click the paper clip or filing cabinet next to the item. |

| • | Users can add and update notes for a line item. |

| • | To view separate pages for GAAP to STAT and STAT to TAX, datasets must be assigned as “yeprovgs.” For more information, refer to the Administration section. |

Global Access users can enter information in the current activity, deferred only, and balance sheet only fields using the income statement approach. Users can input an ending balance amount and have the program calculate the current activity using the balance sheet approach. Administrators can activate the balance sheet approach through a parameter. However, even with this parameter, Global Access users still have the option to take either approach by deferred item.

Notes:

| • | If a new temporary difference item is required, contact the Corporate Tax Department. |

|