The Payable page allows you to enter items that impact your current tax payable account. This information is used for two purposes: 1) to collect the cash taxes paid, and cash refunds received, for the given period for each unit and 2) to complete the rollforward of the tax payable account, starting with the prior year’s ending balance. The sum of the beginning balance of the payable account, any entries entered in the Payable section, and the current provision amount should equal the ending balance amount.

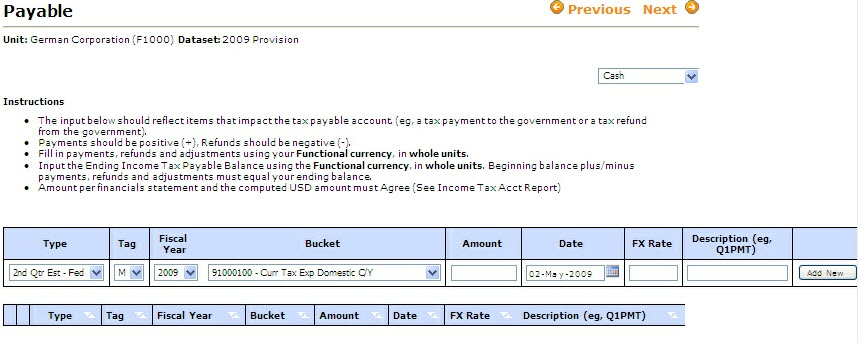

Enter a separate line item for each Payable entry:

| 1. | Select the transaction from the drop-down list in the upper right-hand side. |

| 2. | Enter a unique type, tag, fiscal year, and bucket, along with the amount of the entry in local currency, the date of the entry, the FX rate, and the description for that entry. Note: The format of the date entered must be exactly as indicated on the page. |

You can attach files to individual payable items on this page. If you have supporting documents, click the paper clip icon next to the item.

The impact of tax payments, refunds, adjustments, and current tax provision adjustments on your ending tax payable can be viewed on the Payable Rollforward and Payable Rollforward by Transaction reports.