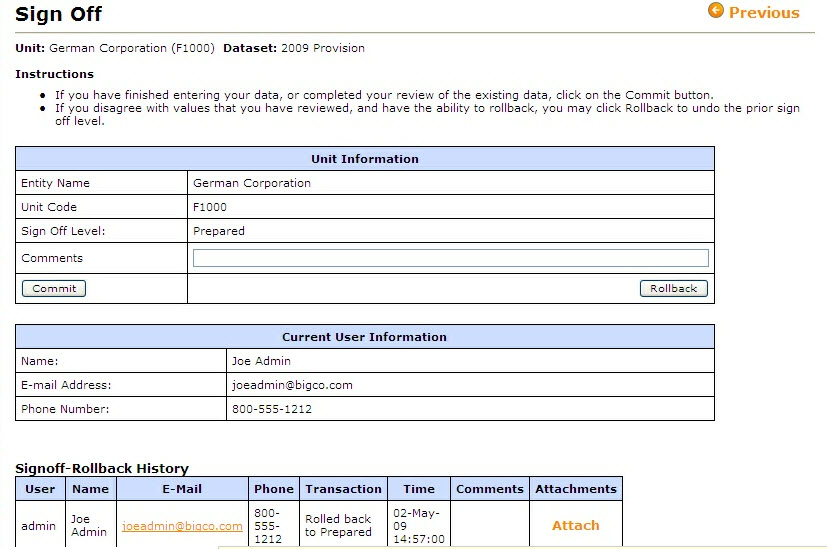

The Sign-Off page allows you to indicate that: (a) unit data entry is complete and (b) you have signed off on the tax provision calculation. When unit data entry is complete and entered on the appropriate pages, review the provision. Also, review the reports, including the current tax provision, deferred tax provision, and effective tax rate to make any necessary changes. When you are satisfied with the tax provision calculation, select the Commit check box.

You can attach files upon your sign-off of each unit. If you need to make changes to the data for a unit for which you have already signed off, contact your Corporate Tax Department and ask them to roll the unit back to you.

Note: Only one level can be rolled back. Administrators can set up users with specific sign-off roles on the Administration page. They can also set up the system so that users can roll back and make changes to data at any level. User contact information can also be prepared by Administrators in Corporate Edition. For more information, refer to the Administration section.