Deferred Balance Report in the Balance Sheet View

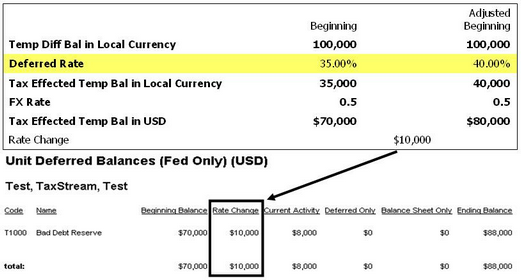

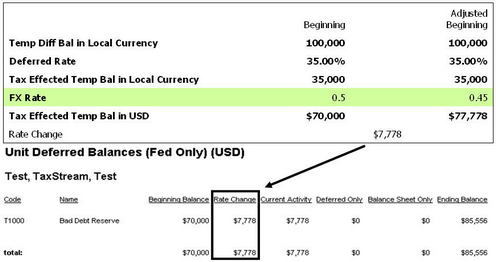

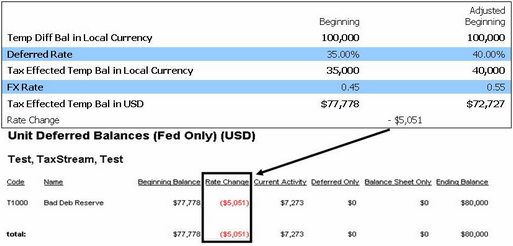

| • | Beginning Balance column balances are converted using the Beginning Spot Rate and the Beginning Tax Rate. |

| • | The Rate Change column creates an adjustment to restate the Beginning Balance column at the Ending Spot Rate and the Ending Tax Rate. |

| • | All other Columns are converted using the Ending Spot Rate and the Ending Tax Rate. |

| • | The Ending Balance is the sum of the columns, and is effectively the ending balances converted using Ending Spot Rate and the Ending Tax Rate. |

Example of Change in the Deferred Rate from 35% to 40%:

Example of Change in the FX Rate from .5000 to .4500:

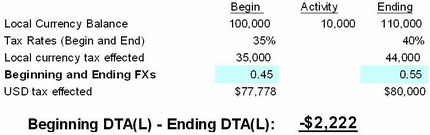

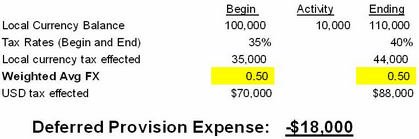

Example of Change in the Deferred Rate from 35% to 40% and FX Rate from .4500 to .5500:

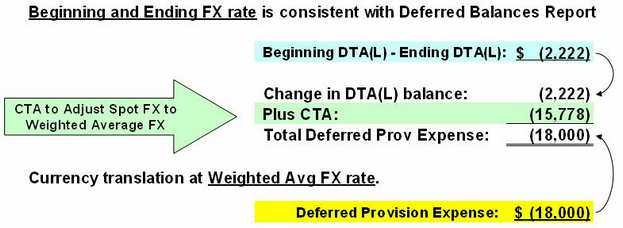

Deferred Balance Report in the Income Statement View

| • | Currency Translation Adjustment |

| • | Deferred Balances in USD are translated from the Local Currency Balances using Beginning and Ending Spot FX Rates |

| • | USD Change in Deferred Balances |

| • | Deferred Expense in USD is translated from Local Currency Activity using Weighted FX Rates |

| • | USD Deferred Expense |

| • | Currency Translation Adjustment Computation |

| • | Adjusts the Weighted Average FX Impact and the Ending Spot FX Rate |

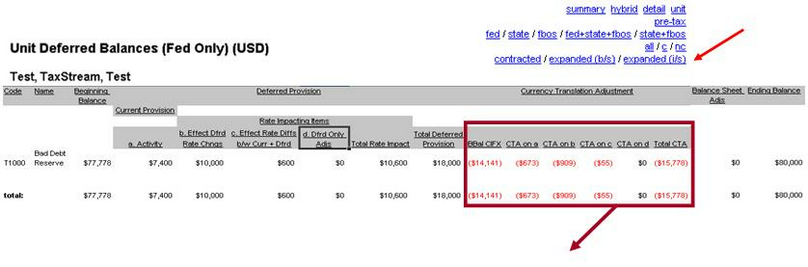

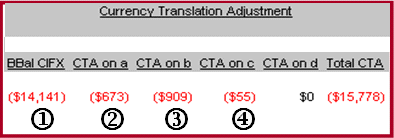

Detail of CTA Calculation Components

Information for the Calculation: |

|

|

|

Beginning Temporary Difference Balance |

100,000 |

|

|

Temporary Difference Activity |

10,000 |

|

|

|

|

|

|

Beginning FX Spot Rate |

0.45 |

Current Tax Rate |

37% |

Ending FX Spot Rate |

0.55 |

Beginning Deferred Tax Rate |

35% |

Weighted Average FX Rate |

0.50 |

Ending Deferred Tax Rate |

40% |

j |

(14,141) |

= 100,000 * 35% / 0.55 - 100,000 * 35% / 0.45 |

k |

(673) |

= 10,000 * 37% / 0.55 - 10,000 * 37% / 0.50 |

l |

(909) |

= 100,000 * (40% - 35%) / 0.55 - 100,000 * (40% - 35%) / 0.5 |

m |

(55) |

= 10,000 * (40% - 37%) / 0.55 - 10,000 * (40% - 37%) / 0.5 |

CTA Amount Displays on the Tax Provision Report