There are five Pre-Tax Book Income policies that can be assigned to units. Each policy asks for different input and generates results based on the information entered for the unit. Select the best policy for the data you wish to populate and the calculations that the system should perform.

Policy |

Local Currency PTBI |

Reporting Currency PTBI |

FX Rate |

Rounding |

Enter Local, FX and Calc USD |

Entered |

Calculated |

Entered |

N/A |

Enter USD, FX and Calc Local |

Calculated |

Entered |

Entered |

N/A |

Enter Local, USD and Calc FX |

Entered |

Entered |

Calculated |

N/A |

Enter Local, USD and FX |

Entered |

Entered |

Entered |

N/A |

Enter Local, USD, FX and Calc Rounding |

Entered |

Entered |

Entered |

Calculated |

| • | When using the last two policies, the Effective Tax Rates may differ in Local Currency and Reporting Currency, because the PTBI is using a different Weighted Average rate than the entered Weighted Average. |

| • | Regardless of the policy selected, amounts other than the PTBI are converted at the entered Weighted Average or Spot Rate. If the unit is using the Enter USD, FX, and Calc Local, FX policy, you cannot save the PTBI amount you entered. It will always revert back to the amount calculated. To modify the amount, the unit must have another policy. |

| • | Depending on the PTBI policy in use, certain fields default to read-only. Any component that is selected to be calculated by the system automatically becomes read-only in the system. For example, if the Enter Local, USD, Calc FX policy is selected, the Weighted Average FX Rate automatically becomes a read-only field on the Unit Data page in Global Access. |

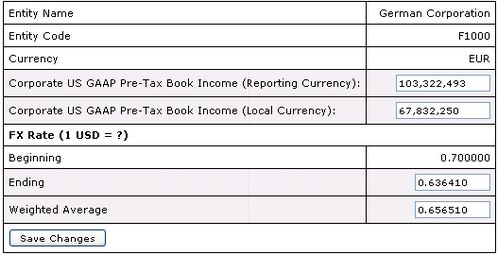

Enter Local, FX, and Calc USD

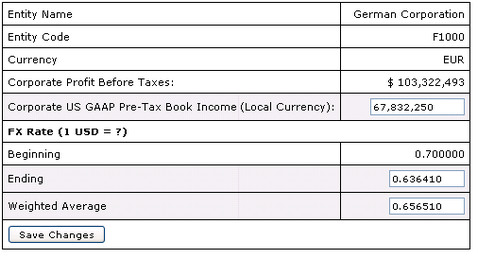

Enter USD, FX, and Calc Local

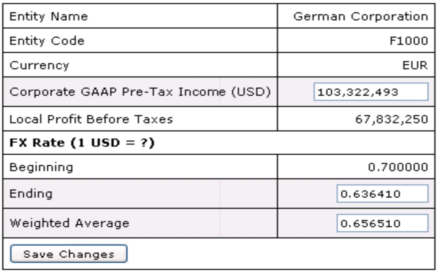

Enter Local, USD, and Calc FX

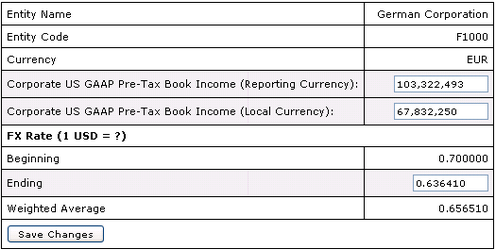

Enter Local, USD and FX and Enter Local, USD, and FX Calc Rounding